How does the council manage your money?

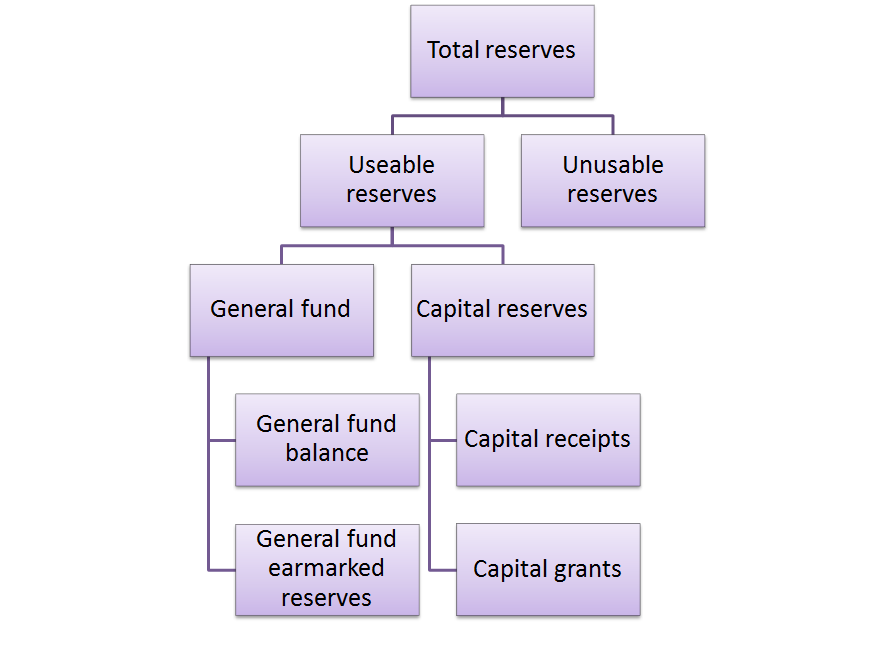

Councils manage your money by dividing it between two pots of reserves - useable reserves and unusable reserves (an explanation of these terms can be found below).

Managing your money in this way means that we can budget successfully for what we need to deliver services now whilst building up funds that will grow over time and so protecting services in the future.

The chart and explanations below illustrate how those reserves are split.

Useable reserves: This is money that each council has set aside to provide services such as rubbish collection and for its day to day running. Useable reserves are made up of two further pots known as the 'general fund' and 'capital reserves'. These two useable reserves are in turn made up of other pots of money.

Unusable reserves: The unusable reserves pot contains funds that cannot be used to provide services or used for day to day running costs. The unusable reserves hold funds that have 'unrealised gains or losses'. This means that we have assets such as buildings whose value changes over time. There may also be commitments linked to these assets such as loans or maintenance needs. The funds held in the unusable reserves fund can only be unlocked and turned into usable money if the assets are sold.

General fund balance: This is a contingency fund - money set aside for emergencies or to cover any unexpected costs that may occur during the year, such as unexpected repairs.

Earmarked reserves: This is money that has been set aside for a particular purpose, such as buying or repairing equipment or the maintenance of public parks or buildings.

Capital receipts: This is the name given to the income received when assets are sold (such as land or buildings). Capital receipts can only be used to buy or fund capital expenditure. Capital expenditure is the money spent on buying assets that have a lasting value. These assets could be land, buildings or large pieces of equipment such as vehicles. Capital expenditure can sometimes also be used to fund grants to people or organisations.

Capital grants: Capital grants are sums of money given to councils by the government. This money can only be used as capital expenditure, in other words this money can only be used to buy assets of lasting value.